About Pkf Advisory Llc

About Pkf Advisory Llc

Blog Article

Getting My Pkf Advisory Llc To Work

Table of ContentsFacts About Pkf Advisory Llc UncoveredSome Known Factual Statements About Pkf Advisory Llc The smart Trick of Pkf Advisory Llc That Nobody is Talking AboutSome Of Pkf Advisory LlcIndicators on Pkf Advisory Llc You Need To Know

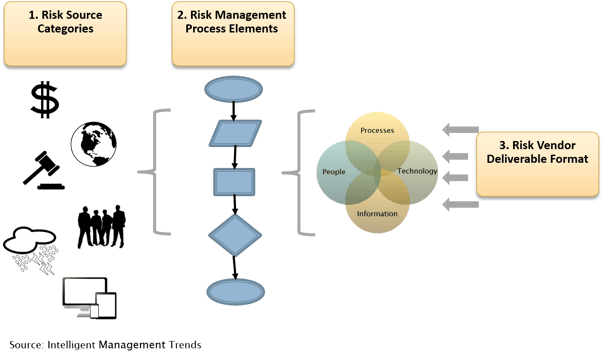

Centri Consulting Danger is an inevitable part of operating, but it can be managed via thorough assessment and management. In reality, most of inner and outside dangers firms encounter can be addressed and minimized through threat advising best practices. It can be tough to gauge your risk exposure and use that details to position yourself for success.This blog site is developed to assist you make the appropriate choice by addressing the inquiry "why is risk consultatory essential for organizations?" We'll likewise review internal controls and discover their interconnected connection with business threat monitoring. Merely placed, organization risks are avoidable inner (strategic) or external risks that impact whether you attain your organizational goals.

Every company should have a strong danger monitoring plan that details existing risk degrees and how to minimize worst-case circumstances. Among the most crucial risk advisory best methods is striking a balance in between securing your company while also promoting constant growth. This calls for carrying out worldwide techniques and governance, like Committee of Funding Organizations of the Treadway Payment (COSO) inner controls and business risk administration.

Unknown Facts About Pkf Advisory Llc

One of the best ways to manage risk in business is with quantitative analysis, which uses simulations or stats to assign risks certain numerical worths. These presumed values are fed right into a risk model, which creates a series of outcomes. The results are analyzed by threat managers, who utilize the data to determine organization chances and alleviate unfavorable outcomes.

These reports additionally include an examination of the effect of negative results and reduction plans if unfavorable occasions do happen - market value analysis. Qualitative danger devices consist of cause and impact representations, SWOT evaluations, and choice matrices.

With the 3LOD version, your board of supervisors is accountable for threat oversight, while senior management establishes a business-wide risk society. Responsible for owning and mitigating threats, operational managers oversee everyday company dealings.

What Does Pkf Advisory Llc Do?

These tasks are normally managed by monetary controllership, quality assurance groups, and conformity, who may additionally have obligations within the very first line of protection. Interior auditors provide neutral guarantee to the initial two lines of protection to guarantee that threats are dealt with properly while still fulfilling functional objectives. Third-line employees need to have a direct connection with the board of directors, while still keeping a connection with monitoring in monetary and/or legal abilities.

An extensive collection of internal controls should include items like settlement, paperwork, security, permission, and separation of responsibilities. As the variety of ethics-focused financiers remains to boost, numerous organizations are adding environmental, social, and administration (ESG) standards to their interior controls. Investors make use of these to figure out whether a business's worths align with their very own.

Social requirements examine just how a business manages its partnerships with workers, consumers, and the larger community. Governance criteria examine a company's leadership, internal controls, audits, investor civil liberties, and executive pay. Strong internal controls are vital to company risk management and considerably boost the possibility that you'll achieve your goals. They additionally boost effectiveness and improve compliance while simplifying operations and assisting stop scams.

Not known Facts About Pkf Advisory Llc

Developing an extensive set of internal controls entails technique positioning, standardizing policies and treatments, procedure paperwork, and developing roles and responsibilities. Your internal controls need to include danger advising finest methods while constantly staying focused on your core company objectives. One of the most efficient inner controls are purposefully set apart to avoid potential problems and lower the risk of monetary scams.

Creating good interior controls entails carrying out regulations that are both preventative and detective. They include: Limiting physical accessibility to equipment, inventory, and money Splitting up of obligations Authorization of invoices Confirmation of costs These backup procedures are created to discover unfavorable outcomes and dangers missed by the very first line of protection.

Internal audits involve a detailed examination of an organization's internal controls, including its accounting practices and click for source business monitoring. They're made to ensure regulatory compliance, along with precise and timely financial reporting.

8 Simple Techniques For Pkf Advisory Llc

According to this regulation, monitoring teams are legally in charge of the precision of their company's financial declarations - transaction advisory services. In addition to shielding investors, SOX (and interior audit support) have actually substantially improved the reliability of public accountancy disclosures. These audits are executed by unbiased 3rd parties and are created to review a business's accountancy procedures and internal controls

Report this page